In a previous post, we noted that, from an Intellectual Property and legal perspective, American voters are treated as consumers, and politicians can become trademarks.

We were sent a thought-provoking and interesting video by OnlineMBA.com, which creatively argues that government should not be run like a business:

This video advances a few arguments comparing businesses and governments generally.

First, it notes that the core purpose of government is fundamentally different from that of a corporation. For example, it argues that the U.S. federal government is responsible for managing the divergent, competing priorities of over 300 million Americans, and it alone must secure the general welfare by building and maintaining roads and bridges, providing for the common defense, and the like. The video contends that voters are "people," which are more important than "profits."

If a government becomes profitable, it argues, that government is probably hording tax dollars for no good reason. In contrast, a corporation is legally bound to advance one goal: amass profits, and a massive cash reserve can promote its positive fiscal growth.

While it is generally true that government serves a different legal and social purpose than a corporation, this video misses the mark.

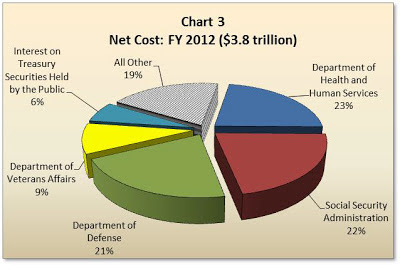

First, it ignores the reality that the U.S. federal government has clearly become a major player in the commercial sphere, in its own right. The U.S. Treasury Department reports that current federal expenditures affect huge swaths of the private, domestic economy with trillions of dollars spent each year by the federal government on private defense contracts, the post office, as well as social program spending.

The Treasury Department also notes that federal spending is anticipated to exponentially increase in the decades ahead, mostly to service interest on the debt, to pay for existing expenditures.

Therefore, the video's general proposition that the federal government should not be concerned about amassing profits is not a realistic assessment of the current situation anyway. The government's budget should at least be solvent, if not profitable.

It is worth noting that the U.S. federal government's budget is currently much larger than that of dozens of mega corporations combined, and its decisions have major fiscal as well as political consequences.

Indeed, a recent story on NBC News noted that the federal government is better at creating low-paying jobs than Wal-Mart.

Therefore, the government MUST be run like a mega corporation, if it is going to act like one.

Further, another argument that the video advances is that shareholders and citizens have fundamentally different "rights" within their respective systems. A minority shareholder in a corporation, for example, has no meaningful say in whether to remove a failing CEO, the video argues.

This analogy is weak and imperfect. Within a larger framework of a properly functioning stock market, a shareholder can always choose to "vote with his feet," and sell his share in the corporation to someone else. Therefore, his potential impact is greater in affecting change in that manner in that particular corporation, than his shareholder proxy "vote."

If such an aggrieved minority shareholder, along with thousands of other shareholders, chooses to dump and sell his stock, presumably the failing CEO will be fired or forced to resign. Consequently, the value of a single share in that company will decrease if the CEO is doing a poor job at managing it.

In comparison, an American citizen cannot "sell his vote" in quite the same way, since he has limited options. Because the federal goverment holds a constititional monopoly on power, there is no competition with it. Ironically, the aggrieved American voter is in an actually weaker position than a minority shareholder in a corporation, at least in comparison.

Finally, at least with respect to presidential elections, it is worth noting that a large segment of the American populace is effectively disenfranchised because of the Electoral College. Democratic voters in "red states" and Republican voters in "blue states," have effectively no vote in the Presidential election.

In summary, the debate will continue to rage on as to what extent government should emulate private industry, and vice-versa.

Thursday, May 16, 2013

Monday, May 13, 2013

Will Bitcoins Spur Even More Online Lawlessness?

Much has already been written about the rise of a new digital currency, the Bitcoin. To some commentators, the Bitcoin is a new type of gold, representing the emergence of a borderless online world, free of annoying governmental interference and ridding the world of obsolete local currencies. To others, the Bitcoin represents just another bubble, or at worst, is the latest shift to a lawless, online "wild west."

But what is Bitcoin exactly? The Bitcoin is

a digital currency based

on an open source cryptographic

protocol and not managed by any central governmental or financial authority. Bitcoins

can be transferred through a computer or smartphone without any intermediate financial institution.

The value of a Bitcoin has fluctuated wildly, leading some to speculate that it is the conceptual equivalent of tulip bulbs in Holland in the seventeenth century, which witnessed the absurd valuation of the flowers' roots.

Apart from its sheer novelty, one part of the allure of the Bitcoin is that it can be used in transactions on the black market for all manner of contraband such as drugs and weapons. Another "benefit" to the Bitcoin is its ability to avoid governmental regulations. Consequently, it has become a hacker's dream come true.

Since each Bitcoin transaction is largely independent of any financial institution's intermediary involvement, it becomes difficult if not impossible for governments to restrict or regulate Bitcoin trade as they would traditional currency flow.

Recently, the U.S. Financial Crimes Enforcement Network (FinCen) issued a formal statement clarifying the scope of various recordkeeping requirements in the Bank Secrecy Act to different types of Bitcoin transactions.

One relevant question raised by some Intellectual Property owners is to what extent an increase in online Bitcoin transactions will even further complicate current efforts to regulate online commerce.

The answer is uncertain. However, given the challenges already involved in ensuring international banking compliance comports with intellectual property rights, the Bitcoin promises only more headaches ahead.

Ironically, the Bitcoin itself is already reportedly being counterfeited, and hackers are stealing them from online "wallets," raising questions about how realistic expectations are that it could possibly function as an actual currency.

Pfizer to Sell Viagra Direct to Consumers Online, Blames Counterfeiting

Pfizer, Inc. is reportedly preparing to sell Viagra-brand sildenafil citrate

tablets online directly to consumers, without the need for a pharmacist.

A prescription from a licensed medical doctor is still required. CVS Caremark Corp. will fill the orders made on the company's website, Pfizer said.

Pfizer

attributes the unusual move to the prevalence of online counterfeiting, according to a recent story in the L.A. Times.

Online

pharmacies have proliferated in recent years, selling fake versions

of Viagra and other brand-name drugs at low prices and with no prescription

needed.

Viagra

has become one of the most popular drug products to counterfeit given its high

price and the embarrassment some men experience ordering the drug from a local

pharmacy.

When

announcing its move to include online sales, Pfizer cited a recent study that found as few as 3% of websites selling prescription

drugs were legitimate pharmacies selling genuine goods.

Viagra is

one of Pfizer's top drugs, posting $2 billion in worldwide revenue last

year.

Vultures Still Circling After the Boston Marathon Bombing

Now that the dust has just begun to settle on the horrific Boston Marathon terrorist attack of April 15, 2013, and the perpetrators are either buried or in custody, there is another sad aftermath: consequences from those cashing in on the victims' suffering by exploiting Intellectual Property through fraud and abuse.

For example, hundreds of fake Boston Marathon-related scams popped up purporting to help the victims, requiring authorities, including the IRS, to issue stern warnings.

Time magazine notes that hundreds of Boston Marathon-themed domain names were quickly registered and put up for auction within hours of the tragedy's unfolding.

Others sought to cash in by trying to federally register trademarks for "Boston Strong," leading to serious questions about their bona fides.

Finally, gruesome and unlicensed photos were stolen from Getty images and the Associated Press, and sold on Amazon.com in unauthorized e-books. After an outcry, Amazon pulled the e-books.

The predictably sad repeat of these transparently opportunistic activities after recent tragedies has led some to consider whether anti-fraud laws should be enhanced to include stiffer penalties for fraudulent activities after a mass casualty occurs.

Tommy Gun Maker Sues Al Capone For Boozy Trademark Infringement

At issue is the fact that Capone Industries has been selling a new brand of vodka under the Tommy Guns name in a bottle that is intentionally shaped like a Tommy gun.

Saeilo owns a federally registered trademark for TOMMY GUN in connection with actual firearms, and the trademark has been used constantly since 1920 in connection therewith (including use by the Chicago gangster, not the Chicago liquor company).

The gun maker is also the owner of a separate TOMMY GUN trademark that covers clothing. Saelio does not apparently own any federal trademark on the name for alcoholic beverages.

In contrast, Al Capone Enterprises owns a current federally registered trademark for TOMMY GUN for beer, wines and spirits.

The complaint, which was filed in federal court in Chicago in March 2013, alleges that Al Capone Industries does not have authorization to use the Tommy Gun trademarks on alcoholic beverages that carry a reproduction of the Tommy Gun name and distinctive shape.

Additionally, Saeilo claims that Capone’s conduct not only violates federal trademark laws, but also Illinois state law and common law. Saeilo further brought claims under Illinois’ Trademark Registration and Protection Act, as well as the Illinois Deceptive Trade Practices Act.

As owner of the trade dress rights in the design of the Thompson submachine gun or “Tommy Gun,” Saeilo claimed that Capone’s unlawful use of the Tommy Gun trade dress was likely to cause “confusion or mistake and/or is likely to deceive consumers as to the affiliation, connection of association of [Capone] with Saeilo,” and of course, Saeilo seeks a permanent injunction and damages.

As owner of the trade dress rights in the design of the Thompson submachine gun or “Tommy Gun,” Saeilo claimed that Capone’s unlawful use of the Tommy Gun trade dress was likely to cause “confusion or mistake and/or is likely to deceive consumers as to the affiliation, connection of association of [Capone] with Saeilo,” and of course, Saeilo seeks a permanent injunction and damages.

An

interesting legal question arises as to whether and when phrases used to describe

firearms can be legally trademarked by the gunmaker, or even by others, in connection with alcoholic beverages.

For

example, the trademark of Colt Buntline Special .45 is owned by Colt's Patent

Firearms Manufacturer. But Colt 45 in connection with clothing is

owned by Pabst Brewing Company. It is unclear why Pabst does not own a federally registered trademark for Colt 45 in connection with its malt liquor beverages.

What if the Redskins Lose Their Trademarks, But Keep Using Them?

|

| The Washington Redskins' logo |

On

Thursday, March 7, 2013 the Trademark Trial and Appeal Board for U.S. Patent

and Trademark Office (the "TTAB") heard oral arguments in a case involving a decades-old question: whether the Washington Redskins' federal trademark

registrations should be cancelled because they are allegedly offensive to Native

Americans.

The case has now been fully briefed and submitted for a

decision. All that remains now is the court's determination: Will the Washington Redskins

franchise lose its federal trademark registrations?

Commentators' predictions are mixed. Some argue that, if history is any judge, it would appear that Native Americans are poised to win this most recent battle cancelling the Washington Redskins' famous trademarks. Others aren't so sure, but argue that the poor publicity involved should counsel a branding change.

All commentators agree that what

would likely occur if the worst case scenario happens to the Redskins would be years of further appeals to delay the

impact of the ruling. Will the Washington Redskins continue use its brand in

the interim?

When

confronted with this question, the owner of the team announced that it will "NEVER change its

name." (capital letters in original).

But what

would happen, long term, if the team loses its federal trademark registrations?

Wouldn't the team still possess at least some rights to prohibit third party

uses?

Probably not. Third parties would begin using the name in an unauthorized manner, and take their chances. Without any federal trademark registrations and with a precedential public ruling finding the marks to be offensive and scandalous, the team would face an uphill battle legally protecting and further monetizing its existing brands.

From a

practical standpoint, the team would probably face an onslaught of rampant counterfeiting that it could not legally stop. Without any valid or enforceable federal trademark

registrations on file, the team would not be able to avail itself of the criminal and other protections

that the law authorizes against counterfeiters. Similarly, there would no

longer be any legal bar to importation of unauthorized items bearing the team's name or logos.

Perhaps

worse yet, the various lucrative licenses for team-branded products and third

party endorsements could be prospectively ignored on the grounds that the

team lacks any appreciable intellectual property rights to further license.

It is also worth noting that, even if the team wins this round in the TTAB, some Congressional Democrats have attempted to legislate the issue against the team.

Perhaps the moral of the story is "never say

never" when it comes to branding and intellectual property.

Subscribe to:

Comments (Atom)